Europe is seeing a decline in new car registrations. In June 2025, this indicator decreased by 4.4% compared to the same month of the previous year. For the first half of the year, registrations fell by 0.3%. Against this background, there has been a significant increase in registrations of Chinese cars. They are already ahead of the sales of some traditional Western brands and are among the five most popular manufacturers in Europe.

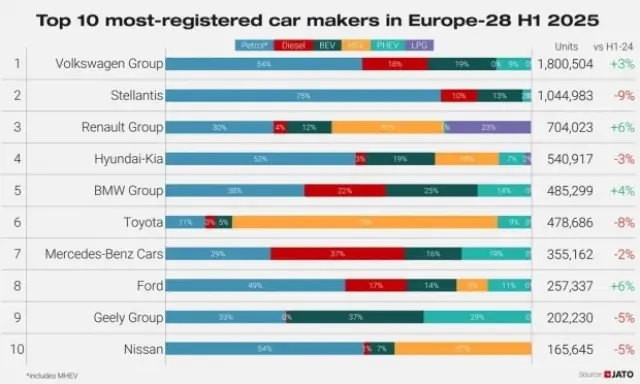

In total, Chinese carmakers sold 347,100 cars in the first half of 2025, an increase of 91% compared to last year. As a result, they have already conquered 5.1% of the European market. This figure is only 0.1 percentage points less than Mercedes (5.2%), but significantly more than Ford (3.8%).

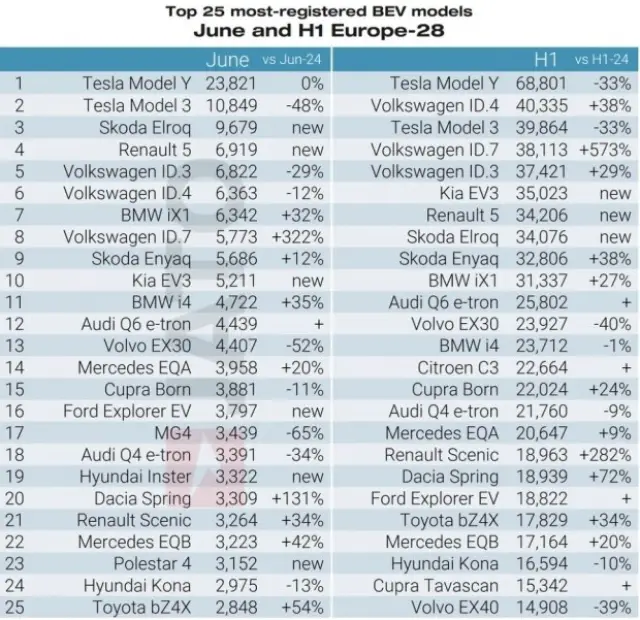

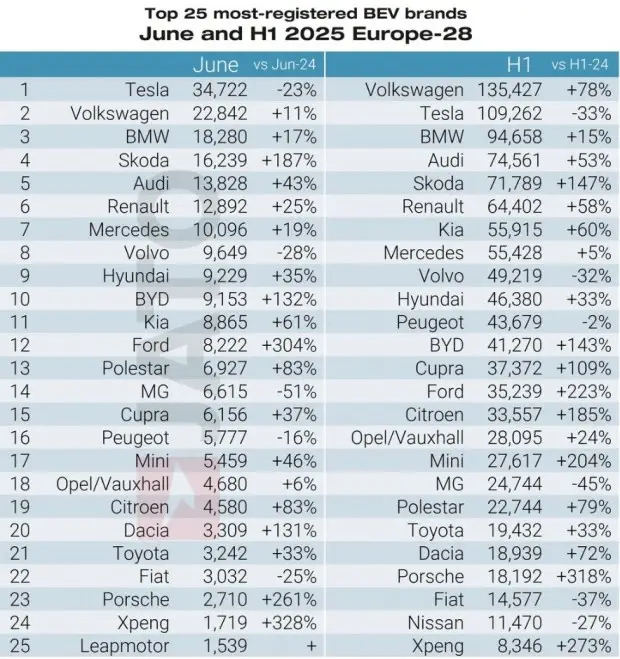

BYD has established itself as a leader among Chinese brands. The company increased its sales of electric vehicles by 133% in June and by 143% in the first six months of the year. BYD sold 41,300 electric cars, ranking 12th among electric vehicle brands by number of registrations. For comparison: Cupra has sold 37,400 electric vehicles, and Ford – 35,200.

The breakthrough of Chinese companies is not only due to electric cars. Plug-in hybrids - especially models from BYD, Jaecoo and Omoda - have also proven to be extremely popular. For example, in June, the BYD Seal U ranked first among plug-in hybrids along with the Volkswagen Tiguan, becoming the most popular plug-in hybrid in Europe.

Among the European manufacturers, not all were able to maintain their positions. While VW Group (+3%), Renault (+6%), BMW (+4%) and even Ford (+6%) showed growth, Tesla lost 33% of its sales, and Stellantis - 9%.

The most dramatic decline was observed with the Tesla Model Y, which until recently was the best-selling electric car in Europe. In the first half of the year, its sales fell by 33% to 68,800 cars and it did not even enter the top ten.

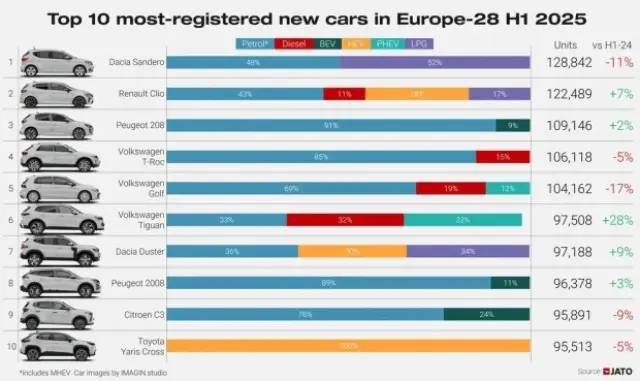

The Dacia Sandero remains the most popular car in Europe, although its sales fell by 11% to 128,800 units, but it should be borne in mind that the model is at the end of its life cycle. The Renault Clio is in second place with a 7% increase to 122,500 registrations. The Peugeot 208 takes third place, followed by the VW T-Roc, Golf and Tiguan.

Meanwhile, the overall electric vehicle market grew by 25% and for the first time in history exceeded 1 million registrations in six months, reaching 1.2 million vehicles from January to June. Analysts are marking this as a significant moment for the automotive industry.