The US will take control of Venezuela's vast oil reserves and hire American companies to invest billions of dollars to rebuild the country's devastated oil industry. This was announced by President Donald Trump during a special press conference on the occasion of the capture and removal of Nicolas Maduro from Venezuela.

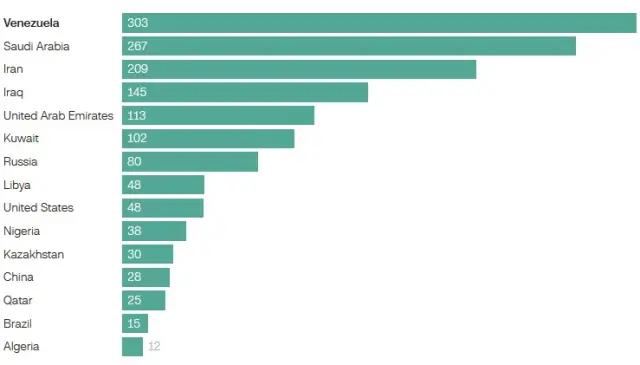

Venezuela has a huge reserve of 303 billion barrels of crude oil. This represents nearly one-fifth of the world's reserves, according to the US Energy Information Administration (EIA). This crude oil supply will play a central role in the country's future.

Oil futures are not traded over the weekend, so the short-term impact on oil prices is a bit of a guessing game, but Trump said the United States will run Venezuela's government, at least for the time being, CNN reported.

“We're going to get our very big oil companies in the United States – the biggest anywhere in the world, to come in, spend billions of dollars, fix the badly damaged oil infrastructure“, Trump said at a news conference at Mar-a-Lago.

Leading Countries by Crude Oil Reserves, 2023 (Billion Barrels)

The US-led revamp could ultimately make Venezuela a much larger oil supplier, create opportunities for Western oil companies and serve as a new source of production. This could also keep broader prices in check, although lower prices could discourage some U.S. companies from producing the "black gold".

Even if international access were fully restored today, getting Venezuela's oil production back up and running could take years and cost an incredible amount of money. Venezuela's state-owned oil and natural gas company PDVSA says that its pipelines haven't been upgraded in 50 years and the cost of upgrading the infrastructure to return to peak production levels would be $58 billion.

"This is a historic event for the oil world," said Phil Flynn, senior market analyst at Price Futures Group. “The Maduro regime and former Venezuelan President Hugo Chavez have effectively looted Venezuela's oil industry.“

Control of Venezuela's Oil Fields

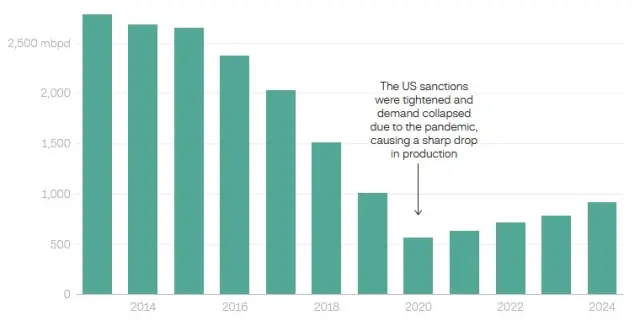

Venezuela is home to the largest proven oil reserves on Earth, but its potential far exceeds actual output: Venezuela produces only about 1 million barrels of oil per day—about 0.8% of global crude oil production.

That's less than half of what it produced before Maduro took control of the country in 2013, and less than a third of the 3.5 million barrels it pumped before the socialist regime took power.

Average daily crude oil production in millions of barrels per day

International sanctions against the Venezuelan government and a deep economic crisis have contributed to the decline of the country's oil industry, but so has a lack of investment and maintenance, according to the EIA. Venezuela's energy infrastructure is deteriorating and its oil production capacity has been significantly reduced over the years.

Venezuela simply doesn't produce enough oil to make that much of a difference in price

Oil prices have been under control this year due to concerns about oversupply. OPEC increased production but demand fell slightly as the global economy continues to struggle with inflation and affordability following the price shock from the coronavirus pandemic.

US oil briefly rose above $60 a barrel when the Trump administration began seizing oil from Venezuelan ships, but has since fallen back to $57 a barrel. So the market reaction - if investors think the strike is bad news for oil supplies - will almost certainly be muted.

“Psychologically it may give a little boost, but Venezuela has oil that can be easily replaced by a combination of global producers,“ Flynn said.

Venezuela's Oil Potential

The type of oil Venezuela has - heavy, sour crude - requires special equipment and a high level of technical power to produce. International oil companies have the ability to extract and refine it, but they are prohibited from doing business in the country.

The United States, the world's largest oil producer, has light, sweet crude that is good for making gasoline but not much else. Heavy crude, like that from Venezuela, is crucial for certain products made in the refining process, including diesel, asphalt, and fuels for factories and other heavy equipment. Diesel is in limited supply around the world, largely because of sanctions on Venezuelan oil.

Unlocking Venezuelan oil could be particularly beneficial to the United States: Venezuela is nearby and its oil is relatively cheap, a result of its sticky, muddy texture that requires significant refining. Most American refineries are built to process Venezuelan heavy oil and they are significantly more efficient when using Venezuelan oil than American oil, according to Flynn.

“If American companies are allowed to come back and rebuild the Venezuelan oil industry, it could be a game changer for the global oil market,“ Flynn said.

Trump called Venezuela's oil business “a total bust”. “They were pumping almost nothing compared to what they could be pumping,“ Trump said.

“We're going to get our very big oil companies in the United States – the biggest anywhere in the world, to come in, spend billions of dollars, fix the badly damaged infrastructure, the oil infrastructure, and start making money for the country,” he added.

What's next for oil prices

It's unclear how energy prices will be affected by the U.S. intervention in Venezuela.

Bob McNally, president of Washington-based consulting firm Rapidan Energy Group, told CNN that he thinks the impact on prices will be "modest" but doesn't expect a major impact, "unless we see signs of widespread social unrest and things look messy. It's more likely if that looks "stable".

Oil markets open Sunday night. Prices will depend on whether Trump “can demonstrate a turnaround“ of Venezuela's oil sector,” said Helima Croft, head of global commodities strategy at RBC Capital Markets.

“It all depends on whether Venezuela resists the recent history of U.S.-led regime change efforts,“ Croft told CNN. “President Trump has signaled that the United States is returning to “nation-building mode” and that U.S. companies will make the necessary investments to ensure the oil sector is revived.” I think we need a lot more detail before we declare “Mission accomplished”.