Repeated Ukrainian strikes on Russian energy infrastructure have severely affected Moscow's vital fuel exports just as Western sanctions are tightening. But if these attacks are too successful, they risk drawing the ire of US President Donald Trump.

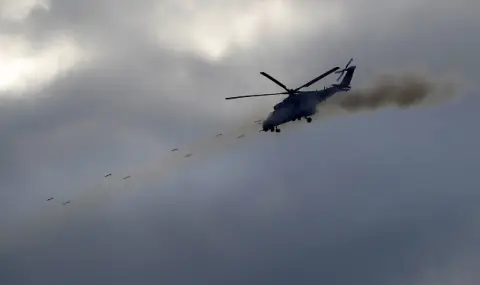

The conflict that began between Russia and Ukraine in 2022 has taken a sharp turn in recent weeks after Kiev launched a series of drone attacks on Russian refineries, pipelines and export terminals. This has had a serious impact on Russia's vast oil and gas industry, which accounts for a quarter of its GDP.

Ukraine stepped up its attacks on Wednesday, when its drones attacked Salavat, one of Russia's largest petrochemical complexes, for the second time in less than a week, as well as the Black Sea port city of Novorossiysk.

Moscow was sufficiently shaken to respond appropriately. Deputy Prime Minister Alexander Novak announced yesterday that Russia will impose a partial ban on diesel exports until the end of this year and extend an existing ban on gasoline exports.

Russia is a major exporter of diesel, having shipped about 880,000 barrels of diesel last year, accounting for 12% of global diesel exports by sea, according to data from analyst firm "Kpler".

Although the diesel ban only applies to traders and not refiners, which account for about three-quarters of total exports, the news will still lead to sharp increases in global diesel prices. Diesel refining margins in Europe - the profit that refiners make from processing crude oil into diesel - rose 8% to their highest level since February 2024, according to data from financial market data company LSEG.

The strong market reaction is partly due to already dwindling global diesel inventories. According to the U.S. Energy Information Administration, U.S. distillate inventories, which include diesel and heating oil, were 11% below their 10-year average last week.

But markets could be uneasy that the opening of a new front in the Russia-Ukraine war will provoke an even stronger response from Russia - much stronger than Western leaders hope.

A multitude of threats

Russian President Vladimir Putin certainly did not take the decision lightly, as the sharp reduction in diesel exports deprives Moscow of vital resources. Revenues from the export of refined products by sea reached about $170 million per day in August this year, or $5.3 billion for the entire month.

Most importantly, it should be noted that Putin made the decision as Western sanctions against the Russian oil and gas industry intensified. Over the past few years, Europe, the United States, and other leading Western economies have carefully crafted sanctions to limit Moscow’s energy export revenues while avoiding a global price shock.

Thus, while Western powers have agreed to largely ban imports of Russian oil, they have not attempted to completely halt the flow of Russian crude.

Instead, the G7 has introduced a price cap for Russian oil in 2022 that shippers and insurers must meet to avoid sanctions.

This strategy has averted a global supply shock, but the financial impact on Moscow has been limited by the significant expansion of Russia’s so-called shadow fleet of tankers that trading partners use to evade Western sanctions. In fact, 64% of Russia’s August crude oil exports were carried by tankers from the shadow fleet, an 11% increase from the previous month, according to the non-governmental Center for Energy and Clean Air Research.

And that’s not the only way to circumvent restrictions. A loophole in the EU sanctions package allowed India and Turkey to import cheap Russian energy and resell it to Europe in the form of refined products. In response, the EU adopted its 18th package of sanctions against Russia, which lowered the price ceiling on crude oil exports to $47.60 per barrel from $60. Russian diesel exports were subject to a $100 cap, which the EU did not lower. In addition, the EU plans to introduce a ban on exports of refined petroleum products made from Russian crude.

But these measures alone did not prompt Russia to retaliate with a partial ban on diesel exports. It did so only after Ukrainian drones began attacking its refineries, suggesting that it is the combination of economic and military attacks on its energy industry that is irking the Kremlin.

Trump’s dilemma

The apparent effectiveness of this strategy could prove problematic for Western economies, because it could upset the delicate balance between punishing Moscow and avoiding sharp increases in energy prices.

This is especially true for Trump, whose campaign promise was to lower energy prices for American households. This could also explain the ambivalence in his relationship with Moscow.

On the one hand, Trump has agreed to attacks on Russian energy infrastructure, according to statements by Zelensky after an interview with him yesterday. But on the other hand, Trump is not very keen on tightening sanctions on the Russian oil industry as he has repeatedly threatened, arguing instead that the first step should be taken by Europe, which would have to stop buying Russian oil and gas altogether. This hesitation can certainly be linked to concerns about rising gas prices and inflationary pressures.

A Ukrainian strategy targeting Russian energy infrastructure could therefore prove profitable for Kiev in terms of reducing Russia’s revenues, but if it provokes retaliatory measures from Moscow that would lead to a sustained increase in oil prices, Ukraine would lose the fragile support of the White House.

Translated from English: Nikolay Dzhambazov, BTA