See all the details and details of the 2025 Convergence Report in the form of questions and answers:

What is the Convergence Report?

Convergence Reports are published every two years or when there is a specific request from a Member State to assess its readiness to join the euro area. The last regular report on Bulgaria was published in June 2024. The European Commission's 2025 Convergence Report was prepared at the request of Bulgaria on 25 February 2025.

The European Commission's 2025 Convergence Report concludes that Bulgaria fulfils the conditions for adopting the single currency. The report is the basis for the Commission's proposal for a Council decision on the adoption of the euro by Bulgaria.

The convergence report examines Bulgaria's fulfilment of the four nominal convergence criteria and the compatibility of its legislation with the requirements of the Treaty and the Statute of the European System of Central Banks and of the European Central Bank (ECB). The Commission's assessment also takes into account additional factors related to economic integration and convergence, including changes in the balance of payments and the integration of product, labour and financial markets.

The European Commission's Convergence Report is published separately, but in parallel, with the ECB's own Convergence Report, the press service of the European Commission Representation in Bulgaria indicates.

What are the convergence criteria?

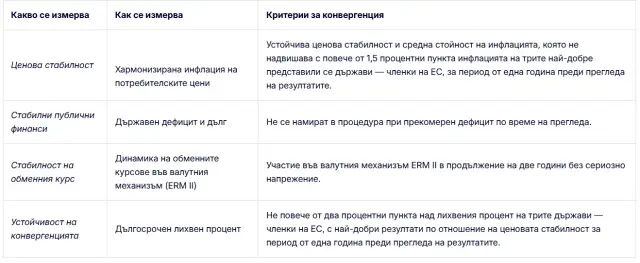

Member States adopting the euro are required to achieve a high degree of sustainable economic convergence. This is addressed in the convergence report by reference to the convergence criteria. These criteria (also known as the “Maastricht criteria“) are set out in Article 140(1) of the Treaty on the Functioning of the European Union (TFEU). They aim to ensure that a country is ready to adopt the euro and that its economy is sufficiently prepared to do so.

Sustainability is a key aspect of the assessment of the Maastricht criteria, meaning that progress made in terms of convergence must be based on structural elements ensuring its durability, rather than on temporary factors. Illustrating in a simplified manner, the criteria are as follows:

The Treaty also provides for a check on the compatibility of the national legislation of the Member State concerned with the Treaty and with the Statute of the ESCB and the ECB. Legal compatibility mainly concerns three areas: central bank independence, the prohibition of monetary financing and the integration of the national central bank into the European System of Central Banks (ESCB).

In addition, the Treaty also requires that other factors related to economic integration and convergence be considered. These additional factors include the integration of the labour market, the financial market, the goods and services market and the balance of payments. The assessment of the additional factors is seen as an important indication of whether a Member State's integration into the euro area would be smooth.

What does it mean to fulfil the convergence criteria?

The fulfilment of these criteria shows that the economy of the country concerned has reached a reasonable degree of convergence with the euro area economy. It reflects the country's ability to maintain economic stability and to integrate into the economic framework of the euro area.

The economic conditions for entry aim to ensure that the economy of the Member State in question is sufficiently prepared to adopt the single currency and can integrate smoothly into the euro area without risk of disruption for the Member State or the euro area as a whole.

The fulfilment of these criteria does not automatically lead to membership of the euro area. The decision requires approval by the Council of the EU, based on a proposal from the European Commission, after the European Parliament and the ECB have delivered their opinions.

Are all non-euro area Member States obliged to join the euro area?

All Member States, except Denmark, which negotiated an opt-out clause in the Maastricht Treaty, are legally obliged to join the euro area. However, it is up to individual countries to shape their path towards the euro and there is no timetable for this.

The Member States that joined the EU in 2004, 2007 and 2013, i.e. after the creation of the euro, did not meet the conditions for joining the euro area at the time of their accession. That is why their accession treaties provide time for them to make the necessary adjustments.

Does the Convergence Report provide guidance to countries on the remaining part of their path to the euro?

The Convergence Report assesses whether the countries — EU Member States — outside the euro area meet the necessary conditions for adopting the euro. It provides detailed analysis and information on the economic convergence of these countries and may suggest areas where further improvement is needed. However, the report does not foresee specific measures and policies.

The Convergence Report is a crucial document for both the countries aspiring to join the euro and the EU institutions. It ensures transparency and provides a clear assessment of the countries’ readiness. This helps to maintain economic stability and coherence within the EU.

The report also forms the basis for a possible proposal from the Commission to the Council to allow a Member State to adopt the euro.

What are the main findings of the 2025 special convergence report requested by Bulgaria?

The 2025 report finds that Bulgaria fulfils the conditions for adopting the euro:

- Bulgaria's legislation is compatible with the requirements of the Treaty and the Statute of the European System of Central Banks and of the ECB.

- Bulgaria fulfils the criterion on price stability. The average inflation rate in Bulgaria in the 12-month period to April 2025 was 2.7%, below the reference value of 2.8%. The examination of a broad range of indicators does not reveal any reasons for concern with regard to the sustainability of price stability.

- Bulgaria fulfils the criterion on public finances, as it is not subject to a Council decision on the existence of an excessive deficit.

- Bulgaria fulfils the criterion on the exchange rate. It joined the Exchange Rate Mechanism II (ERM II) in July 2020 and has participated in the mechanism for almost five years at the time of adoption of this report.

- Bulgaria fulfils the criterion on the convergence of long-term interest rates. The average long-term interest rate in the 12 months to April 2025 was 3.9%, below the reference value of 5.1%.

The Commission also examined additional factors, including developments in the balance of payments, market integration and the institutional environment.

In light of this assessment, the Commission considers that Bulgaria is ready to adopt the euro on 1 January 2026.

What is the process for a Member State to adopt the euro and what are the next steps for Bulgaria?

Once a Member State has fulfilled all the necessary criteria, the European Commission's convergence report forms the basis for a decision on the adoption of the euro. The Commission submits a proposal to the Council, which — after consulting the European Parliament and following discussions in the Eurogroup and between the Heads of State or Government — decides whether the country fulfils the conditions for adopting the euro.

If the decision is positive, the Economic and Financial Affairs Council takes the necessary legal steps and - on the basis of a proposal from the Commission and after consulting the European Central Bank (ECB) - adopts the exchange rate at which the national currency will be replaced by the euro. This exchange rate then becomes definitively fixed.

In the case of Bulgaria, the Commission concluded that the country fulfils the four nominal convergence criteria and that its legislation is compatible with the requirements of the Treaty and the Statute of the European System of Central Banks and of the ECB. Taking into account the additional relevant factors, the Commission considers that Bulgaria is ready to adopt the euro.

As a result, the Commission adopted proposals for a Council Decision and a Council Regulation on the introduction of the euro in Bulgaria. The Council of the EU is expected to take the final decision in the first half of July after the necessary consultations and discussions.

In the meantime, Bulgaria needs to continue the practical preparations needed to ensure a smooth transition to the euro. The Commission services are in close contact with the public and private stakeholders involved in these preparations and stand ready to provide the necessary technical assistance to the Bulgarian authorities.

To what extent does the convergence report address the process of entering ERM II?

The exchange rate mechanism ERM II was established on 1 January 1999 as a successor to the original ERM to ensure that exchange rate fluctuations between the euro and other Member States' currencies do not undermine economic stability within the single market. It also aims to help non-euro area Member States prepare for their participation in the euro.

The convergence criterion on exchange rate stability requires participation in ERM II. Participation is voluntary, but the exchange rate criterion for euro entry contains the rule that the country must have participated in the mechanism without serious tension for a period of at least two years before adopting the euro. Under ERM II, the exchange rate of a non-euro area Member State is fixed against the euro and can fluctuate only within certain limits.

The decision to join ERM II is taken at the request of a non-euro area Member State by mutual agreement of all ERM II participating Member States: the euro area Member States, the ECB and the ministers and governors of the central banks of the non-euro area Member States participating in the mechanism, i.e. currently Denmark.

Bulgaria announced its intention to join ERM II in July 2018 and committed to implementing a number of measures — so-called ex ante commitments — before joining the mechanism to ensure smooth participation in ERM II. It joined ERM II in July 2020 after fulfilling these commitments. It also committed to and implemented a number of additional measures (known as post-ERM II commitments) designed to preserve economic and financial stability and achieve a high degree of sustainable economic convergence.

European Commission President Ursula von der Leyen said: “The euro is a clear symbol of European strength and unity. Bulgaria is one step closer to adopting it as its currency. Thanks to the euro, Bulgaria's economy will become stronger, benefiting from more trade with euro area partners, foreign direct investment, access to finance, quality jobs and real incomes. Bulgaria will take its rightful place in shaping the decisions at the heart of the euro area. Congratulations, Bulgaria!”

Valdis Dombrovskis, Commissioner for Economy and Productivity, Implementation and Simplification, said: “The report is a historic moment for Bulgaria, the euro area and the European Union. Bulgaria has fulfilled all the convergence criteria to become the 21st member of the euro area. The Communication is the culmination of a five-year process since Bulgaria entered the ERM II exchange rate mechanism in 2020. The euro will bring tangible benefits to Bulgarian citizens and businesses: stable prices, lower transaction costs, protected savings, more investment and increased trade. Of course, the euro is more than just a currency. Since Bulgaria became a full member of the Schengen area earlier this year, the euro has brought the country ever closer to the heart of Europe. Bulgaria's successful integration into the euro area will require continued strong policies to strengthen the competitiveness and resilience of the Bulgarian economy.”