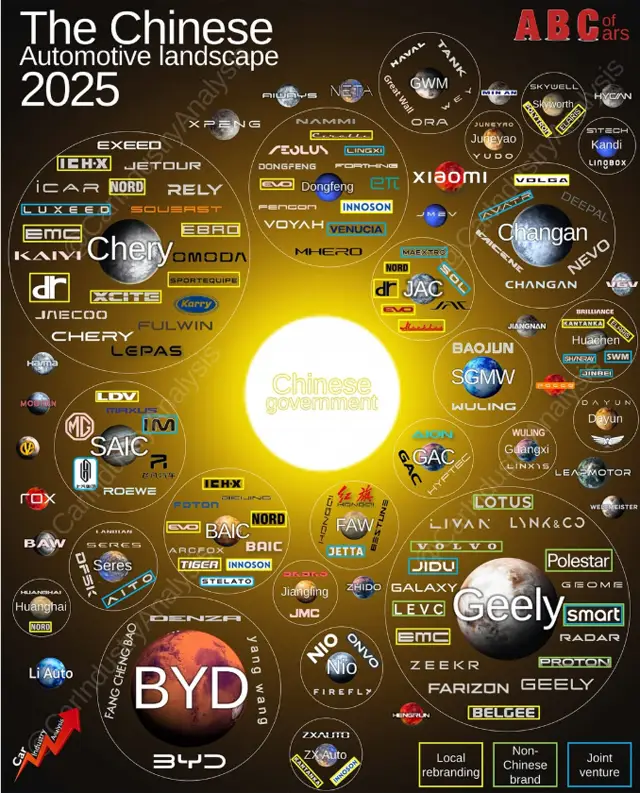

The Chinese auto industry is undoubtedly the most dynamic, but also the most fragmented in the world. With a multitude of brands and start-ups, the question is not who will break through, but who will survive in the next decade. A detailed infographic compiled by industry analyst Felipe Muñoz sheds light on the complex market landscape and outlines the potential losers.

The Four Giants

The analysis clearly shows that the market is firmly held by four main groups, which account for 56% of all sales in China. These are:

Geely: The most diversified group, which includes Volvo, Lotus, Polestar, Smart, as well as the Chinese brands Zeekr, Lynk & Co, Galaxy, etc.

BYD: The group with a more focused portfolio, consisting of BYD, Denza, YangWang and Fan Cheng Bao.

Chery: State-owned, with brands such as Omoda, Jetour, Exeed, iCar and Jaecoo.

Changan: Also state-owned, owning Avatr, Deepal, Nevo and Volga.

These four groups, along with other major players such as SAIC (MG), JAC and BAIC, are heavily involved with the state and receive subsidies from local governments, which further cements their dominance and stability.

Positioning Pyramid: Who's on the Edge?

To explain the risks, Muñoz has arranged the brands in a pyramid according to their market positioning. At the top are ultra-premium brands like Hongqi and YangWang, followed by high-tech contenders – new stars Xiaomi, Nio, Li Auto and Xpeng. These companies, despite being startups, have managed to avoid takeovers so far and have strong positions in the mid- and high-end. The real risk, however, is at the base of the pyramid. Here are the budget brands that are unlikely to survive.

The base level consists of older budget brands that are little known outside of China. Names like Sinogold, Hima and BAW fall into this risk group.

According to Muñoz, these companies risk disappearing first. The reason is simple: Chinese buyers are increasingly turning to more modern, technologically advanced and subsidized companies, abandoning the old, budget offerings. While it is entirely possible that some of them will be absorbed by larger groups, the independent existence of the majority of Chinese brands is in question.

It is clear that the leading Chinese manufacturers will play a key role in the global industry. But this expansion will come at the expense of dozens of smaller players, who will be forced to merge with the giants or leave the market. This is the inevitable consolidation in an oversaturated market.