The transparency of the income and assets of public figures is recognized by international organizations, including the Organization for Economic Cooperation and Development (OECD) and GRECO at the Council of Europe, as one of the most effective tools for preventing corruption and conflict of interest. They point out that public disclosure of the financial interests and bank accounts of MPs strengthens citizens' trust in institutions and limits opportunities for abuse.

This is shown by an analysis by the Institute for the Development of the Public Environment.

Also, in a number of European Union countries, the declaration of deposits, their value and location by persons holding public positions are considered a key indicator of transparency and integrity in their work.

In this context, the review of the declarations of Bulgarian MPs is not just a formality, but a key accountability mechanism that allows society to monitor whether the exercise of public power goes hand in hand with integrity and responsibility. In previous publications by the Institute for the Development of the Public Environment, we have already presented summarized data on the vehicles and available cash of MPs. This information is available in their property declarations submitted to the Anti-Corruption Commission (ACC). In this article, our team will examine how many and what kind of deposits the members of parliament have.

According to the instructions of the CPC, deputies should declare “bank accounts – current, incl. with debit cards, term deposits, savings, etc.”, when their total amount amounts to over 10,000 leva. They are also required to declare accounts in foreign currency, outside the country, as well as the deposits of their spouses and minor children.

What do the data show?

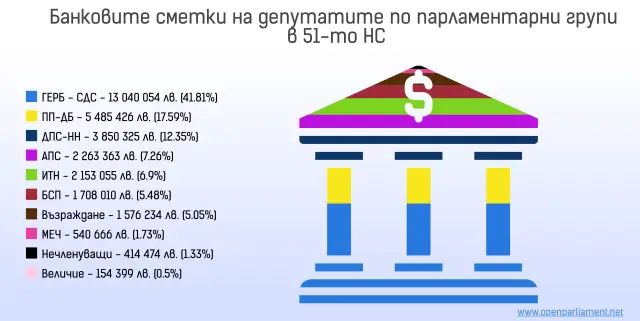

According to the declarations, a total of 189 deputies have declared their deposits in the country and abroad, with their total amount amounting to 31,186,005 leva (1,116,410 of them are in banking institutions outside the country). Another 82 of their partners have accounts worth 5,528,008 leva. Also, 54 of the MPs have declared deposits in foreign currency, such as euros, dollars, British pounds and/or Swiss francs.

The CPC form requires indicating whether the declared deposit is in the country or abroad, but it is not mandatory to enter the specific banking institution. Some MPs have nevertheless included this information, and so among the banks in which our MPs keep their funds are DSK, CCB, UBB, Invest Bank, D Bank and others.

As expected, the MPs from the largest parliamentary group, GERB-SDF, have the most funds in their bank accounts – 13,040,054 leva. They are followed by Continuing the Change-Democratic Bulgaria with 5,485,426 leva and DPS-New Beginning with 3,850,325 leva. A total of 72 MPs have declared amounts worth over 100,000 leva.

It is striking that half of the funds of the GERB-SDF group were declared by MP Lachezar Ivanov, who has 6,423,932 leva in his accounts. The majority of his funds are deposited in a dollar account in the country. He is followed by the leader of the DPS-New Beginning Delyan Peevski with 1,078,026 leva (declared in accounts in Bulgaria in leva, euros and dollars) and Atidje Bayryamova Alieva-Veli from the same party, who has declared 912,988 leva in accounts in Bulgaria and Belgium. We recall that she is a former MEP and with a high degree of probability this explains her account at the headquarters of the European institutions.

Some recommendations

In democratic countries, high salaries for those holding public positions are a mechanism for guaranteeing their independence. At the same time, the publicity of their income is a key tool for ensuring transparency and allows for control by responsible institutions and citizen monitoring by activists, journalists, etc. In this way, asset declarations are actually a kind of deterrent mechanism against abuses and the emergence of conflicts of interest.

However, this tool does not work in the most optimal way in our country. The declarations currently do not allow for full machine processing of the data in them, because the deputies fill them out in a different way. It is also significant that only 189 deputies have declared that they have bank accounts. Given the amount of their remuneration, it is strange that not all of them have declared such. As we have already explained in our previous publication, with a high degree of probability some of the representatives of the people are confused about where they should publish their current accounts. They often do so in the category of “cash on hand”, and not in “bank accounts”. Such discrepancies sometimes make the information unreliable and certainly make it difficult to collect and analyze it. To change this, the instructions for completing asset declarations could be supplemented with practical examples.

The review of the declarations also shows that some MPs indicate in which foreign country their accounts are, but these are isolated cases. The same applies to the type of accounts - whether they are current, savings, etc. It is possible to introduce a requirement for this information to be published.